can i get a mortgage if i owe back taxes canada

Paying electronically is quick easy and faster than mailing in a check or money order. Found out the fee was not waived.

How To Get Preapproved For A Mortgage Bankrate

Each time he requested an extension to file his 1040.

. Recurring monthly debt payments may include. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. We would like to make sure you have the facts about what happened what information was involved and the steps we are taking to protect your information.

Property is a system of rights that gives people legal control of valuable things and also refers to the valuable things themselves. The traditional monthly mortgage payment calculation includes. The IRS can charge a victory tax on gold medals but only certain athletes have to pay it Last Updated.

Pensions property and more. And as long as one is your main home and you use the other for personal purposes you can deduct the mortgage interest home equity loan interest through 2017 only and mortgage insurance premium payments through 2021 only you pay on both. TurboTax is the easy way to prepare your personal income taxes online.

Get all of our latest home-related storiesfrom mortgage rates to refinance tipsdirectly to your inbox once a week. You may have heard reports recently about a security incident involving Myspace. Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees.

In King County Washington property values increased 9 from 2021 to 2022. Or in cash or by check or money order. TurboTax online makes filing taxes easy.

The mandatory insurance to protect your lenders investment of 80 or more of the homes value. First lets address growing property tax values. Become injured or disabled.

The loan is secured on the borrowers property through a process. President Biden Vice President Harris and the US. The amount of money you borrowed.

If your profit exceeds the 250000 or 500000 limit the excess is typically reported as a capital gain on Schedule D. E-file online with direct deposit to receive your tax refund the fastest. About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency.

For income taxes he might owe 1 million for 2016 and 42 million for 2017. NextCrypto Coming soon NextIdea More info. Choose easy and find the right product for you that meets your individual needs.

While the typical loan is a mortgage a home equity loan line of credit or second mortgage may also qualifyYou can also use the mortgage interest deduction after refinancing your homeJust make sure the loan. If youre buying a new home ask your lender if you can port your mortgage. First Payment Due - due date for the first payment.

The monthly cost of property taxes HOA dues and homeowners insurance. You can get an automatic 6-month extension of time to file your tax return. There are a few types of home loans that qualify for the mortgage interest tax deduction.

June of 202- I get another letter saying I owe 500 dollars. July 22 2021 at 1203 am. See chapter 1 later.

Pour obtenir de laide juridique au Canada. Your mortgage can require. Your lender might offer you optional mortgage insurance when you get a mortgage.

Mortgage insurance premium if applicable Homeowners association HOA dues if applicable Back-end ratio is the percentage of income that goes toward paying all recurring minimum monthly debt payments in addition to the monthly mortgage costs covered by the front-end ratio. You can file the paper form or use one of the electronic filing options explained in the Form 4868 instructions. There are however tax deductions the IRS offers that cover the expenses on up to two homes.

They can help you make your mortgage payments or help pay off the balance on your mortgage if you. Key Takeaways If you owned and lived in the home for a total of two of the five years before the sale then up to 250000 of profit is tax-free or up to 500000 if you are married and file a joint return. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language.

The statute of limitations for the IRS to audit your return wont start until you actually file your return. Latest news expert advice and information on money. Found on the Set Dates or XPmts tab.

The cost of the loan. Mortgage Closing Date - also called the loan origination date or start date. That ended fine a few years back.

You should pay with this extension the amount of tax you expect to owe for 2021 figured as if you were a nonresident alien the entire year. These include a home loan to buy build or improve your home. Depending on the nature of the property an owner of property may have the right to consume alter share redefine rent mortgage pawn sell exchange transfer give away or destroy it or to exclude others from doing these things as well as to.

For legal help in Canada visit rlegaladvicecanada. The United States of America has separate federal state and local governments with taxes imposed at each of these levels. If you acquire ownership of a home as part.

August 24 2022 Update. These optional products are different from mortgage loan insurance. So the sooner you.

You cant get your money back until you file so you should file as soon as you can to get your money as soon as possible. July 23 2021 at 1134 am. Taxes are levied on income payroll property sales capital gains dividends imports estates and gifts as well as various feesIn 2020 taxes collected by federal state and local governments amounted to 255 of GDP below the OECD average of 335 of.

From a mobile device using the IRS2Go app. Tax Liens by the Numbers. And each time he made the required payment to the IRS.

To request an extension to file until October 15 2022 use Form 4868. You can pay your taxes by making electronic payments online. I was late in assessment fees in 2020 due to my mother passing from covid.

Try it for FREE and pay only when you file. This means taking your existing interest rate terms and conditions with you to your new home. You can then make a lump-sum prepayment without penalty.

It saves you from breaking your mortgage contract and getting a new one. Department of Education announced a three part student loan debt relief plan that includes an extension of the pause on student loan payments until December 31 2022 debt cancellation and a proposal to create an income-driven repayment plan to help lower future monthly payments.

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

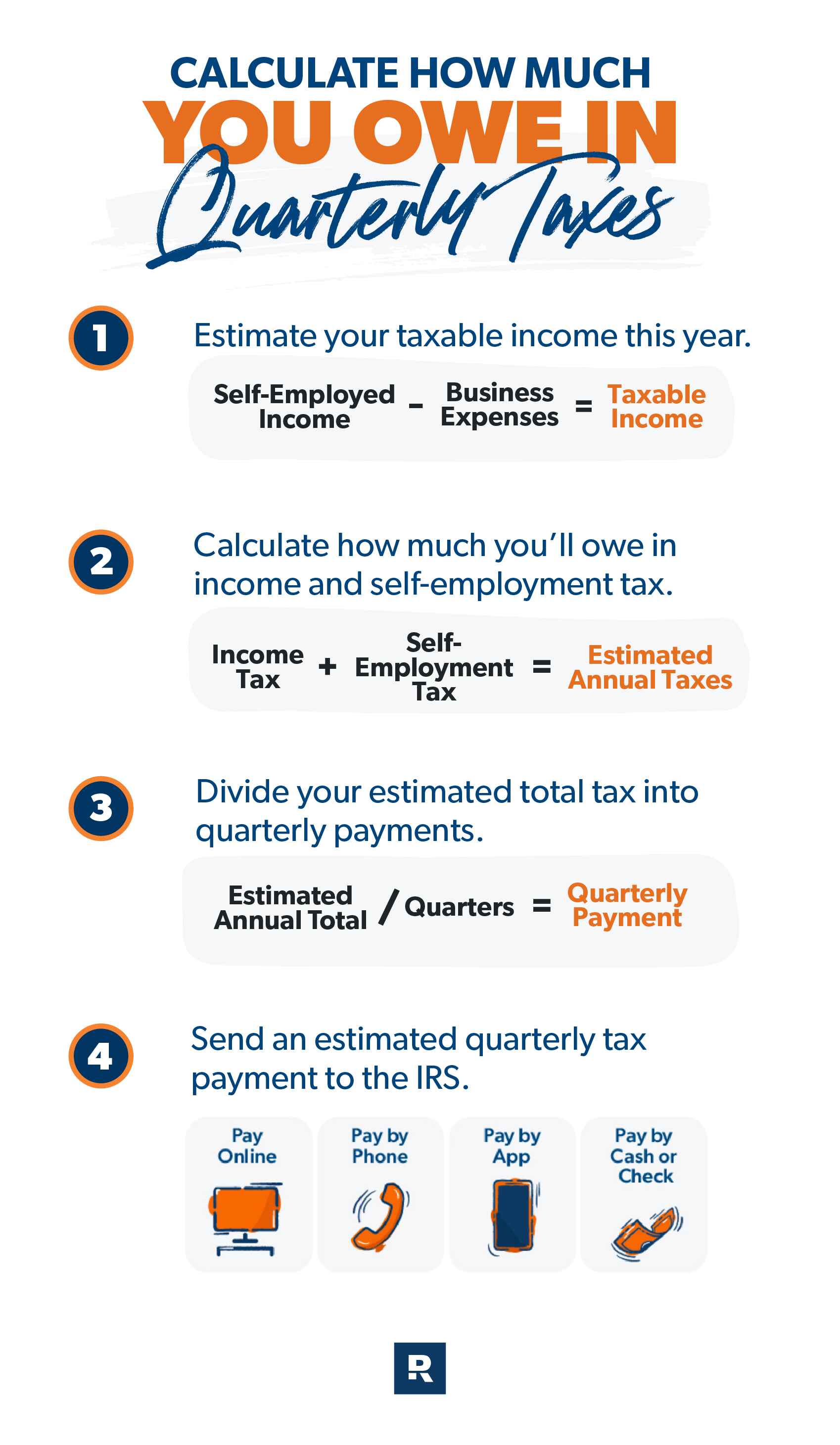

What Are Quarterly Taxes Ramsey

Selling A House With A Mortgage Bankrate

5 Hidden Ways To Boost Your Tax Refund Turbotax Tax Tips Videos

As Mortgage Rates Tick Upwards 8 Secrets To Getting The Lowest Mortgage Rate Marketwatch

Can You Buy A House If You Owe Taxes Credit Com

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Credit And Tax Secrets Canada How To Build Your Credit And Improve Your Credit Score Fast Save Money On Your Corporate Gst Hst Payroll And Personal Tax Mahoni Bashir 9781999273118 Amazon Com Books

Trump S Taxes Show Chronic Losses And Years Of Income Tax Avoidance The New York Times

I Haven T Filed Taxes In 5 Years How Do I Start

Can You Get A Mortgage If You Owe Back Taxes

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Revenue Canada Debt What To Do If You Owe Turnedaway Ca

What Do Mortgage Lenders Look For On Your Tax Returns Better Mortgage

Publication 17 2021 Your Federal Income Tax Internal Revenue Service

How To Read A Monthly Mortgage Statement Lendingtree

How To Find Tax Delinquent Properties In Your Area Rethority

:max_bytes(150000):strip_icc()/remove-a-name-from-a-mortgage-315661-Final-ce467fa819be434898d17ff3d815e642.png)